FAQ > Managing Banks

How do I take rental income and owner contributions and turn them into bank deposits?

To turn rental income and owner contributions into bank deposits, you must first record the owner’s rental income on the property worksheet and the owner’s contribution in the Owner Center. These amounts should be mapped to a specific bank account. Once this is done, the total of these amounts will appear as an undeposited amount in the balance history of the mapped bank account. You can then create a deposit for this undeposited amount by following these steps:

1. Ensure that both the rental income and the owner’s contribution are recorded and mapped to a bank account

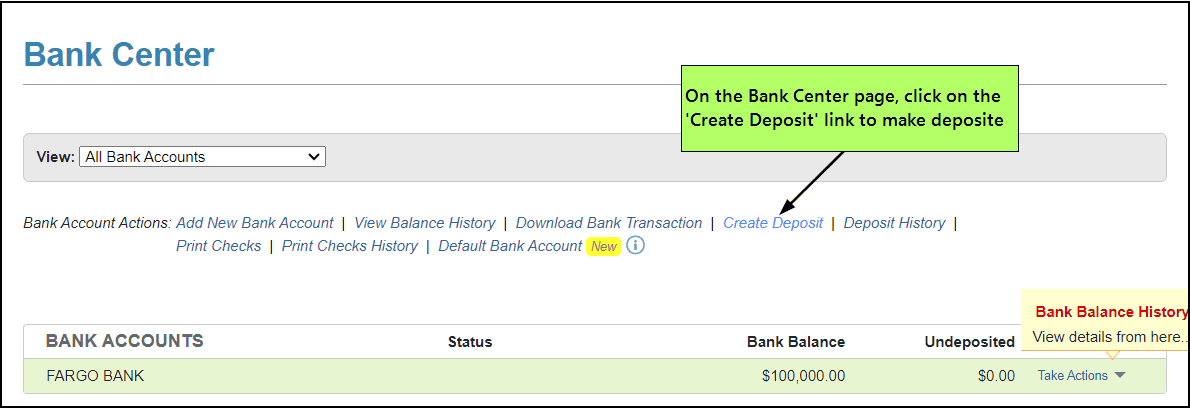

2. Go to the Bank Center page and click the “Create Deposit” link.

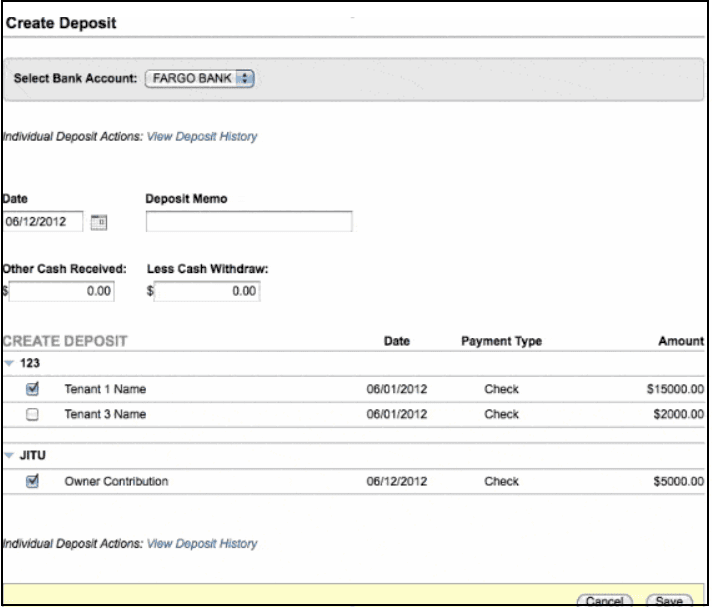

3. On the “Create Deposit” page, select the appropriate bank account from the dropdown menu (this should be the account previously mapped to the transactions).

4. Fill in the required fields and check the necessary deposit checkboxes.

5. Click the save button.

6. To view a record of your deposit, navigate to the bank balance history page. Under the relevant bank account, expand the “Deposits & Credits” row and click on the deposited amount. A popup will show the details of the deposit.