One of the most unpleasant calls you can get from your tenant as a property manager is that there are mice in the property. To get rid of mice and prevent them from appearing again, it requires teamwork from both of you.

It’s also a very common problem, according to the US Census Bureau, 14.8 million homes have reported seeing a roach infestation over a 12 month period.

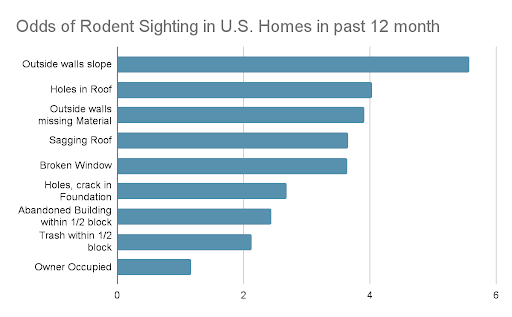

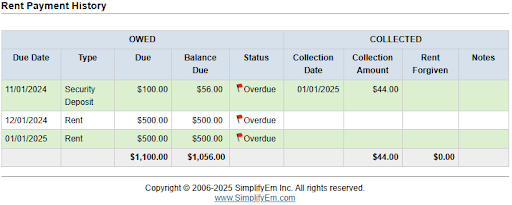

Here is some data on likelihood of Rodent Infestation versus No infestation based on these signs in the home.

It requires preventive measures, such as a mouse repellent strategy that makes the rental property less inviting. If there are mice already in the property, there is a solution to get rid of the mice already there.

What Causes Mice in the Property?

Especially during cooler months, mice look for warmth. So the risk is higher during the autumn and winter time. If you have cracks and openings in your house through the wall, window, basement, foundation or attic, you are more likely to invite mice.

Also, if you have good nesting material such as insulation, cotton, or feather in a pillow that is also attractive.

Finally, food is the other reason for mice to enter your house. Things such as unsealed pet food, open garbage cans, or just open food containers are very attractive to mice.

What Are Natural Repellents for Mice?

First, do all the obvious things. Seal entries into your. Inspect your house for cracks and openings to seal.

Get rid of food sources, by putting all food away in metal or heavy plastic containers. If it’s a paper container or light plastic, mice will be able to get in and get the food supply.

There are smells mice hate, such as peppermint oil, cayenne pepper, and cloves. Try to infuse those fragrances throughout the house.

Other smells that mice hate are smells of cat urine and urine of other predators. You can mimic this with ammonia, if you want a stronger smelling solution.

Other ways to get rid of mice? What is the best mouse bait?

Simple traps like a ‘snap trap’ with the best mouse bait peanut butter work, but obviously they are messy. Typically, it involves a quicker demise for the mice without longer suffering.

There are also electric traps that kill mice with electric shocks. They are effective but can be expensive.

There are also sticky glue mouse traps, but mice can learn to avoid them over time.

You can also use store bought chemical solutions and take precaution when using them around children and pets.

Finally, you can always use a professional pest control service, according to Angie’s list, that can cost from $180 to $600 but can be effective. But it can vary based on the size of your house.

Conclusion

Mice once they infiltrate are hard to get rid of. The best strategy is to seal your house so it’s hard for them to enter. Also, don’t provide any food or shelter source for them.

Frequently Asked Questions on Mice Prevention

- What smells do mice hate?

Mice are known to hate smells like peppermint, clover, and Cayenne pepper. They also hate the smell of Ammonia, since it smells similar to cat urine.

- How long can mice live without food?

Mice can survive 2 to 4 days without food. So if you eliminate their food sources, it’s a very effective mouse repellant strategy.

- Do mice learn to avoid mouse traps?

Mice will learn over time to avoid traps. At first, it’ll be new for them, but over time they learn.

Sources:

https://www.orkin.com/pests/rodents/mouse-control/mouse-deterrents

https://www.fixr.com/costs/mouse-exterminator

https://www.census.gov/library/stories/2021/04/how-many-american-homes-have-pests.html